BTC down over 7% for the month but Algoz outperforms the market

After the near record highs established in May for BTC, analysts were concerned that the rally, created by ETF’s, might run out of steam. That wasn’t evident early in June as the BTC price powered back to $71K but as predicted that rally proved unsustainable and BTC finished the month at just under $62K. A drop of about 8.5% for the month.

Key Crypto moments during the month were :

- Initial indication were that the US economy was slowing down and interest rate cuts, or the prospect of them, is good for crypto. US data towards the end of the month contradicted these early figures with the job market showing no signs of slowing up. Mixed messages create trading confusion.

- Crypto Trump supporters were also cheering as their candidate endorsed the digital eco system – suggesting he would make the US a digital powerhouse. The result – A quick Trump & Dump?

- Analysis by 10x Research showed that for every +1% increase in the BTC price it requires $+0.8bn of inflows – or more simply, a 10% increase needs $8bn of net inflows.

- During the early month BTC rally, ETH broke above the all important $3725 level as supporters were buoyed by news of an imminent approval for ETH, ETFS. Most believe it wont have the same impact as BTC and if there is a rally leading up to it then it may be a case of buy the rally, sell the news.

- Interestingly the gold price tumbled in early June as China indicated it had stopped buying the precious metal. It had enjoyed a good run up to then, closing above $2450 before retreating back to below $2300.

- Mid month there were substantial withdrawals of BTC from exchanges, $6.75bn. The jobs data looked pessimistic but to confuse matters further the CPI data came in spot on at 3.3%, with the FED suggesting, steady as she goes.

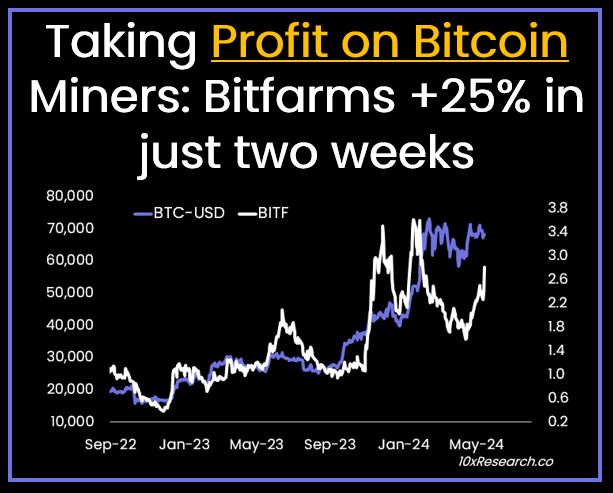

- Profit taking by Miners started the sell off within BTC. Moreover a Hedge against the fact that their break even figure is now close to $60,000 per Coin since the halving, so anything they sell above that is all important profit.

- Altcoins became the focus later in the month as prices declined, with 115 coins now down over 50% since their 2024 highs – that’s a significant drop.

- As ETF momentum stalled and prices fell the BTC chart started to look very much like a “double top” had been put in place. Time will tell.

- A sell off, with BTC down to 60K was seen as an important line in the sand, with clear air down to $55K if it broke these levels. As I write we are below 58K and falling.

Against that backdrop how did Algoz perform?

- Our Momentum strategy finished up 4.8% net and 24.1% net year to date. The Ai part of this is starting to read the cycle length better and reacting accordingly to the 2-3 day rally and slumps. We are hopeful of even more improvement to these numbers in the coming months.

- The more conservative AiQP strategy made 1.1% during the month and with the Barclays Hedge Index showing the basket of traders down -6.1% (figure correct as at 10am UK 3 July) and BTC down 8.5% for the month, this is a strong showing. This strategy has consistently delivered returns with minimal drawdowns and is fast becoming the company flagship for risk adjusted returns. (June Tearsheet attached)

We also have two important announcements

- We are proud to announce that Algoz has been appointed as the first Strategic Partner with Zodia Custody. Our Quant Pro custody product, which eliminates exchange and management counterparty risk using Zodia, is being introduced to the Zodia Custody ecosystem as the benchmark for industry protection during trading and will be highlighted by Zodia to their customer base. This is a huge moment for Algoz and further endorsement that our Quant Pro product is indeed, a safer, better way to trade. (Official announcement to follow)

- We are also releasing our newest strategy, Quant Pro Market Neutral. This strategy is almost unique in crypto. It remains market neutral, has virtually no capacity issues, delivers 20% on an annualised basis and has max daily draw downs of less than 1%. Our Head Trader, Tom Cohen, described it as the crypto strategy that allows you to sleep well at night. Designed for those crossing over from Tradfi, who want to increase their current hedge Fund returns in the safest possible strategy. This is only available to those who own USDT coins but dissimilar to Arbitrage Market Neutral strategies we have no capacity concerns here. This again highlights that Algoz is providing Risk Management at the highest possible level.

We believe that no other company is currently providing a better, risk adjusted product than Algoz. Every day people make decisions to invest in the Crypto space without talking to us. Right now we aredoing everything we can to stop people from making unsafe investments and showing them that there is a safer, better way to invest in Cryptocurrency and that way is definitely Algoz Quant Pro.