I am delighted to report that in another month where President Trump was rarely out of the news and BTC was down almost 18% for February, Algoz made money in all strategies. The BarclayHedge Crypto index is showing down -14.7% (correct as of 21/3/25) for the month, so you can see what a phenomenal performance this was by all three of our key strategies.

Final Figures were : (All net of Fees)

Market Neutral + 5.0%

AiQP +2.6%

Momentum +14.5%

Truly special figures and clearly showing that our strategies perform just as well in bear scenarios as bull.

What were some of the key events during the month in Crypto – wow! – where to start.

- Most importantly and the big drag on the market early in the month was that Trump said nothing about Crypto. So much was in the price for him making good on his hustings promises that it didn’t take much to move the market down as ETF withdrawals gathered steam.

- Tariffs raised their ugly head on Feb 2nd and any inflationary pressure they create is not good for Crypto (He has now of course implemented those tariffs and again we are down)

- The dominance of BTC was also evident. During February the Crypto market contracted by $1 trillion taking it back to levels last seen in March 24 when BTC was $63K. Given that BTC is now $83K you can see the roll out of alt coins and into BTC.

- Ethereum was again very dull. At one time hitting just above $2,000 in February. Given it was above $4,000 in December you can see this roll out highlighted here. Ethereum is fast becoming an irrelevant coin – maybe the next gen Pectra upgrade in March will work its magic – maybe it wont?

- Bitcoin outflows through the ETFs was solid, signalling a wall street concern about the Macro market generally.

- Interestingly just 7% of all BTC is held by wallets with less than 1 Bitcoin. Showing that BTC is now a real institutional play. Most of the BTC holders of less than 1 BTC have done nothing with their coin in the last 3 years. BTC is no longer a retail play – if it ever was.

- Bybit – Lazarus hack of $1.5 billion of Ethereum dominated the market on 21st and added to sentiment woes. Its possible almost all will be reccovered and Bybit showed the strength of their balance sheet throughout. (However, who needs Counterparty risk when you have Quant Pro?)

- For those who follow charts, the sharp decline in BTC completed what was a classic Head & Shoulders as the price retreated briefly to $78K.

And so the month closed out with BTC languishing some 17.82% down and good news a distant memory as the Fed seems caught now with sticky inflation and a declining manufacturing sector and to top things off tariffs everywhere. The macro scene seems particularly confused in the US.

Sometimes it’s hard to see the positive stories but we still have FTX payouts to come, which will no doubt help, strong news from the President on the role of key coins including XRP, ADA & SOL – (all campaign supporters! Just saying) and then of course he added BTC & ETH later. The kick start to the next leg may well be two things. Anything positive Trump says and supports and of course lower inflation figures. The latter may be harder to predict with the impact of tariffs.

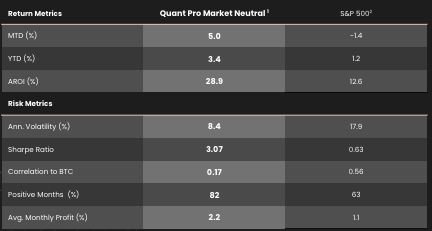

I have attached the Market Neutral tear sheet (AiQP & Momentum are also available – just ask) as that has again significantly outperformed the market this year but we were genuinely thrilled with the performance of all 3 of our strategies. I am also delighted to confirm our nomination as a finalist by Hedgeweek as Best New Solution Provider of the Year. Our Quant Pro model, which eliminates exchange and management counterparty risk, is now being seen by the industry as a “game changer” for risk management and so it should be. Results will be known on the 29th April. We are hopeful!