September looked like it was going to be another tricky month for investors as BTC tested the $52K resistance and ETH the all important $2.2K mark on Sept 6th but a month is a long time in Crypto and a series of factors created a strong near end month finish and the hope of better times to come. That is in spite of the end of month sell off on the last day, which is starting to become a regular occurrence. Tensions in the middle east have dampened enthusiasm as Q4 starts but is this just temporary?

These were just some of the contributory factors to the September trading story

- After the July 31 Fed meeting where the decision was made to postpone rate cuts until September nearly $10 billion in stablecoins were minted, flooding the market with much needed liquidity. This is always a pre-cursor to increased trading and a great insight to markets.

- Post the FMOC meeting Bond yields took a dive from 4.1% to 3.7% in 7 days.

- Just like the Bitcoin falls in April and June, OTC desks have been a persistent seller of Bitcoin, as the price moved down from $65,000 to $61,000, the selling may have paused, at least for now. This analysis is based on data from three separate OTC desks.

- In August AAVE’s lending fees jumped to $43 million a record month for 2024 showing increased activity in the DEFI space.

- Despite the earlier year problems with ETH, gas fees spiked and breathed life back into the coin and ALT coin activity.

- Daily crypto trading volumes of around $2 billion, consistently in the last few weeks in South Korea showed a resurgence in SEA.

- China accounts for about 55% of the worlds BTC mining and the $278 Billion economy stimulus package just announced has meant we have already seen increased BTC trading in China.

- October to March has always been strong with +40% compared to +27% April to September – many have started positioning themselves to take advantage.

- FTX creditors will likely receive confirmation of between 126-140% return on October 7 from Judge Dorsey – and much of this is expected to be available in the market.

- Both Political parties in America have signalled the importance of crypto and so either way the result of the US election is either good or really good for coins.

- US Pension funds number 4 now in the sector with that number set to grow in Q4.

- And most importantly because we are systematic traders and not discretionary, our key Algorithm turned Bullish BTC in all areas just days ago and in the past 12 months it has been very accurate.

So both from a trading perspective and from a birds eye above the market, we are bullish about prospects for Q4, despite the poor start, caused by the Middle East tensions.

However, many of you may know that I am a disciple of Markus Thielen from 10x Research (worth subscribing to if you want to understand the market – or you can just let us do it for you!) who has called this right since early 2023, I will continue to monitor his comments and watch our exposures report to gauge the market, together they have been an excellent guide.

So how did we end up the quarter? In a word – good, not great but good

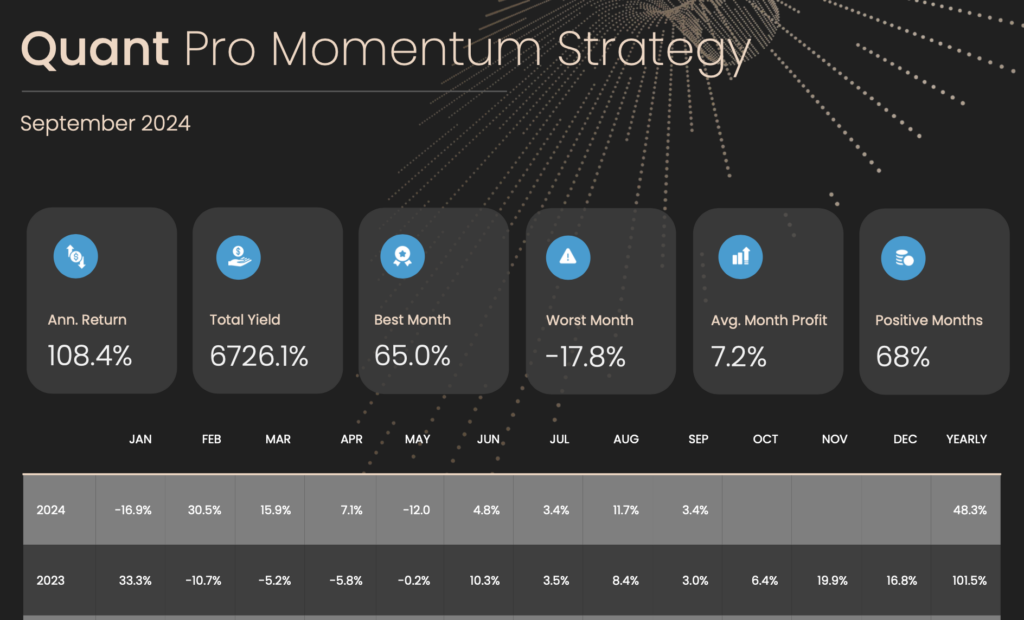

- We finished up 19.4% for the quarter with our Momentum strategy and that makes it up 48.3% year to date, which is very encouraging.

- Our AiQP strategy was up 6.35% for the quarter and almost 20% year to date.

- By way of comparison the Barclays Hedge Index that I often compare to, was down -5.27% for the quarter and up 15.64% year to date. In both cases we have outperformed the market.

Also important to note that during the last quarter BTC went from $71,000 to $63,000, down -11% for the quarter, so making money was not easy for most. Yet again we succeeded where others didn’t.

As illustrated previously, the crypto index has traditionally shown 40% gains between October and March vs 27% gains from April to September. If you don’t have a position now then perhaps it’s time to get one, if you do then maybe it’s the right time to “beef” it up a little.

Note : For more information on any of our strategies please contact the writer.