No 1 on Us Financial Markets – 150,000 Bitcoins in just 3 weeks

After all the hype around the Spot BTC ETF approvals I am sure many are wondering why BTC is some 6000 below it’s highs and if this whole thing wasn’t just a damp squib. The answer is both Yes and No, as is often the case.

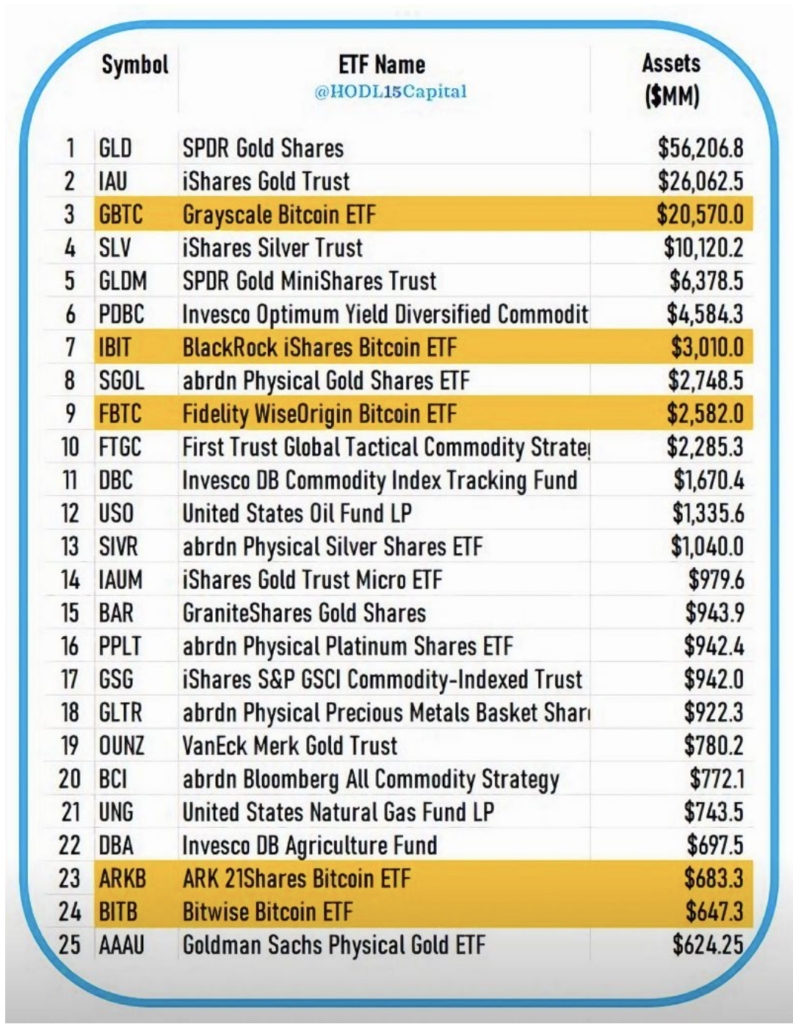

Yes because lots of people hoped that BTC would immediately rally to $55,000+ in the aftermath of the approval and I get that but in reality it was never going to happen that quickly. So some are disappointed and yet No because in just 3 weeks the launch of these funds makes BTC the most successful launch in US financial history. These funds have already amassed over 150,000 bitcoins. So much so that within 2 months BTC will overtake Gold as the number one ETF. (See table below).

This level of promotion by these companies will just continue – the 14 companies who are now actively promoting these ETF’s have over 1 billion customers, all of whom are being exposed to crypto and all of whom are seeing the biggest asset managers in the world now showing them that Crypto is a legitimate asset that is hear to stay. And that ladies and gentlemen is massive!

The Future is 100% Cryptocurrency

Like all things associated with quality investment the rise doesn’t happen overnight but this rise is now unstoppable and that is the key. Governments of the world can no longer go backwards on Crypto, that Genie is now well and truly out of the bottle. It took ten years to get 1% of the worlds population to use the internet and 1 year to double it. Crypto is following exactly the same path. There are now 80 year old + people who couldn’t imagine life without the internet, those people may not see the mainstream adoption of Crypto but it will happen.

So the question now is, how are you positioned to take advantage of the inevitable mass adoption of a new form of currency? Have you taken a lead from the 14 biggest global asset allocators and developed a Crypto policy – because if you haven’t you will be left behind.

In 2023 our flagship AiQP strategy made 50.9% net of fees with a Sharpe Ratio of 3.91 and a max daily drawdown in the year of just 4.3%. There is no doubt these returns can not last forever but certainly for the next 3 years we believe returns of this type will still be possible. Couple that with owning BTC and seeing your coin go from $40,000 to $120,000 (not investment advice) and you can understand why there is a compelling argument for having at least some exposure to Cryptocurrency.

By way of an update our AiQP strategy lost 5.8% in January, which shows you cant make profits every month, even in Crypto! What we did discover is that it is not without precedent. Back in Feb 2022 we lost a similar amount when BTC performed almost identically to this year’s figures. We didn’t look back on it then as the loss was preceded by 10 months of profitable months and followed with another 4 months of profits. We also spotted a similar performance at about the same time before the last BTC halving in 2020. We like to learn and adapt so we are looking at that now in order to see how we might avoid it again in the future. For now, statistically it is just one losing month in 9 and consistent with our overall returns.

For those thinking about investing, now might be an ideal time. Many like to come in on the back of a draw down month and February looks a great place to start.

If you would like to talk through any of the above or find out how Algoz is still the only company in the world to have mitigated exchange and management counterparty risk, whilst providing transparency and instant access to your funds then please just book a time with me using the link below

https://calendly.com/swundke/30min

Algoz Quant Pro proves categorically that there is – a safer, better way to invest in Cryptocurrency, why not let us show you?