“May you live in interesting times” is a quote believed to be translated from a traditional Chinese curse. Currently, I don’t think even President Trump can pin this one on the Chinese. January through March has been, without doubt the most “topsy turvy” trading session that crypto has seen and the new President is pretty much responsible for all of it.

In the month of January alone, the price of BTC had 4 different 10% or more rises and falls. In February we saw a 17% fall in the BTC price overall and then March beat them all with no fewer than 5 market moves of 10% or more. April has already seen one big 12% fall.

Rather than go through the various events of March that lead to this trading pattern, which have been well reported, perhaps some context might be more worthwhile. At the time of writing the newly imposed Trump Tariffs have wiped over $10 trillion off the S&P 500 in the US alone. That’s 3 years worth of gains wiped out in less than 2 months. Global markets generally are in disarray and of course the crypto markets are not exempt from “risk off” fear. However, after some more significant falls (BTC fell back to $72,000 at its low – April 7) it seems the leading Crypto Asset has performed much better than equities in this “mess,” to date and maybe there is reason to believe it might continue to do so! Why?

Reading through some, excellent 10x Research documents, it seems that this Trump administration might have some unfinished business where China is concerned. Looking back to the Chinese Governments “Made in China 2025” document of 2015 might give us an insight as to the current motivation of the US Government. In short, “Made in China 2025” talked about transforming China into a global high tech leader, especially in Ai, semiconductors and aerospace. Some could argue with the recent launch of DeepSeek, and their dominance of the electric car scene across the globe, they may have achieved most of their goals already. Maybe now, this is the Trump fightback and some unfinished business from 2016. This time around he has a team behind him who all seem to agree with him, Treasury Secretary Bessant, Peter Navarro and others look determined to take on the Chinese in all global markets.

Assuming the US sticks to their guns, how might this play out? China has the balance sheet to be able to devalue their currency in a desperate bid to remain globally competitive. They have form for this, they did it back in 2015. Why is that interesting? Because whilst there was a knee jerk fall in the price of BTC of some 20% what followed was an almost 60% rise in the BTC price over the next 3-4 months. Many successful Chinese investors saw BTC as the safe haven against devaluation and that may well play out more strongly this time as the asset has matured and developed. And it might not just be Chinese investors who understand the hedge against currencies that BTC provides. Maybe that’s why Crypto hasn’t seen the massive downside that equities have in the aftermath of the Trump’s latest shockwaves.

There’s another reason to believe that Crypto might just be the right place at the right time. Trump’s approval rating is now around the 40% mark, down from the highs back at the inauguration. He hasn’t stopped either war in a day as he suggested he would, prices are now rising in goods middle America takes for granted (A Chinese built Iphone is $1000 – a US made one $3000 – Nike trainers $100 – US made $400). Very soon he is going to need some “feel good” low hanging fruit and crypto fits the bill perfectly. The President knows how to work the price, it’s part of his manifesto and 40% of US adults own a digital wallet. Maybe that’s talking your own book but anyone who saw him in Nashville at the BTC conference or more recently in New York are under no illusion he likes the sector and wants it to be seen as his legacy – or at least one of about 20 legacies – he’s nothing if not ambitious!!.

Whilst the Chinese devaluation scenario I described is possible it’s plain to see there is a lot of fear in the markets generally. The VIX Inversion, that being the spread between 3 month implied volatility and the current month VIX, is close to all time highs, not seen since Covid and the 2008 crash. It’s clear analysts believe this could be a fight to the death between the US & China and that perhaps there will be only one winner! The question is who and how much damage could this cause?

Enough of the commentary – how did we do in Q1. The answer is good but not great, we certainly outperformed most financial markets.

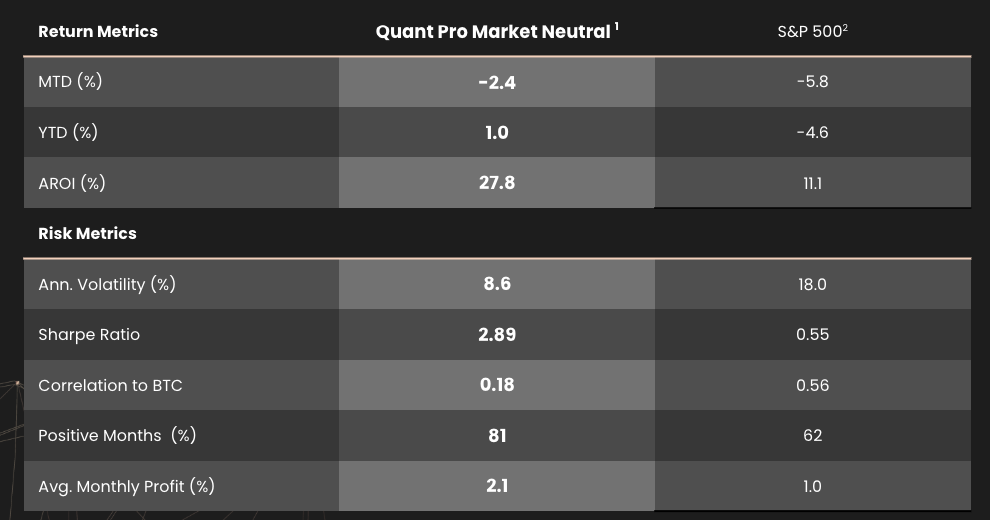

By way of comparison the S&P 500 is down -22% YTD, the Barclays Crypto Hedge Index is showing down -16.49% for Q1, thankfully we were nowhere near that with our strategies. Our star performer was Market Neutral which was actually up +1% for the Quarter (see fact sheet below – end of March figures), showing how well this strategy performs in the toughest environments. AiQP finished down just over 6% for the quarter and Momentum was down just 3%. (Other fact sheets available on request)

As you can see all 3 strategies beat the broader markets. We are never happy with down or flat quarters but given the background described we think that everything performed well within the statistical analysis we provide for our investors and are confident that they will have further improved from this set of trading signals going forward.

We believe the skill in asset management is in not losing big sums when things aren’t ideal for trading and making strong returns when they are. That’s why we concentrate so heavily on drawdowns. Each of the three strategies remains within the quoted drawdown parameters. We think we have weathered the storm pretty well so far and are in a good place to take advantage of some friendly winds. Time will tell. Our track record over 6 years suggests that the best time to invest with us is just after a drawdown so maybe the timing is perfect! That’s your call.